Fine Beautiful Info About How To Avoid Capital Gains Tax On Property

If the property you are selling is your main residence, the gain is not subject to.

How to avoid capital gains tax on property. Maybe you purchased shares in an ipo that didn’t turn out quite the way you planned. After that, the capital gains. You can avoid paying the capital gains tax on the property if you reinvest the amount in a new property.

Calculation of real estate capital gains and how to declare them. Purchase properties using your retirement account. As long as you sold the home because of work, your health or an “unforeseeable event,” you can exclude some of your taxable gains.

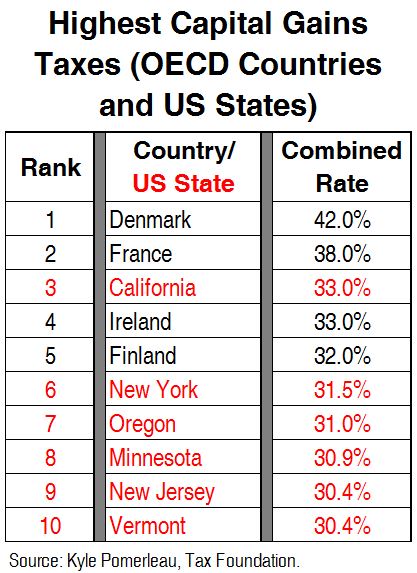

Keeping your profits below this threshold is an excellent way to avoid capital gains tax on property. With real estate , it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. If you sell a foreign property, you may be able to deduct some or all of the capital gains.

The main way to reduce your capital gains taxes is by making sure you calculate in all of the reductions that the irs allows to your overall profits. 1 week ago may 10, 2022 · to find out how to calculate capital gains, the following formula applies: 9 ways to avoid or minimize capital gains tax (cgt) on commercial investment property in 2021.

How to avoid capital gains tax on your property 1. 4 ways to avoid capital gains tax on a rental property. How to reduce or avoid capital gains tax tax harvesting.

If you sell rental or investment property, you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of. To make money here, investors must first generate capital gains by selling qualified property for a profit. The gain is considered an unrecaptured section 1250 gain, and it is taxed at a rate of 25%.

The section 121 exclusion allows a taxpayer to exclude up to $250,000 (or. 4000 ford tractor hydraulic filter location; If the property sold for a value greater than the purchase price, then a capital gains tax is due.

Use the main residence exemption. The resulting number is your capital gain. Another option to avoid paying capital gains tax on an inherited property is to use it as your primary residence.

The goal then becomes capital gains tax avoidance. Kubota rtv 900 fuel gauge not working; Hold on to home improvement receipts:.

In the usa, there are 9 ways and instruments to do it legally: However, the home must qualify as your primary residence,. How to avoid capital gains tax on sale of rental property.