Wonderful Info About How To Avoid Paying Pmi Insurance

How can i avoid paying pmi without 20% equity?

How to avoid paying pmi insurance. How to avoid pmi completely. But people really need to review their finances to see whether dumping all of their savings into a. Make a 20 percent payment.

How to avoid pmi insurance in addition to canceling pmi, it’s also possible to completely avoid paying mortgage insurance from the start of your loan. To use this strategy effectively, you’ll need to take out a mortgage. Here are two ways to completely avoid paying pmi on your mortgage:

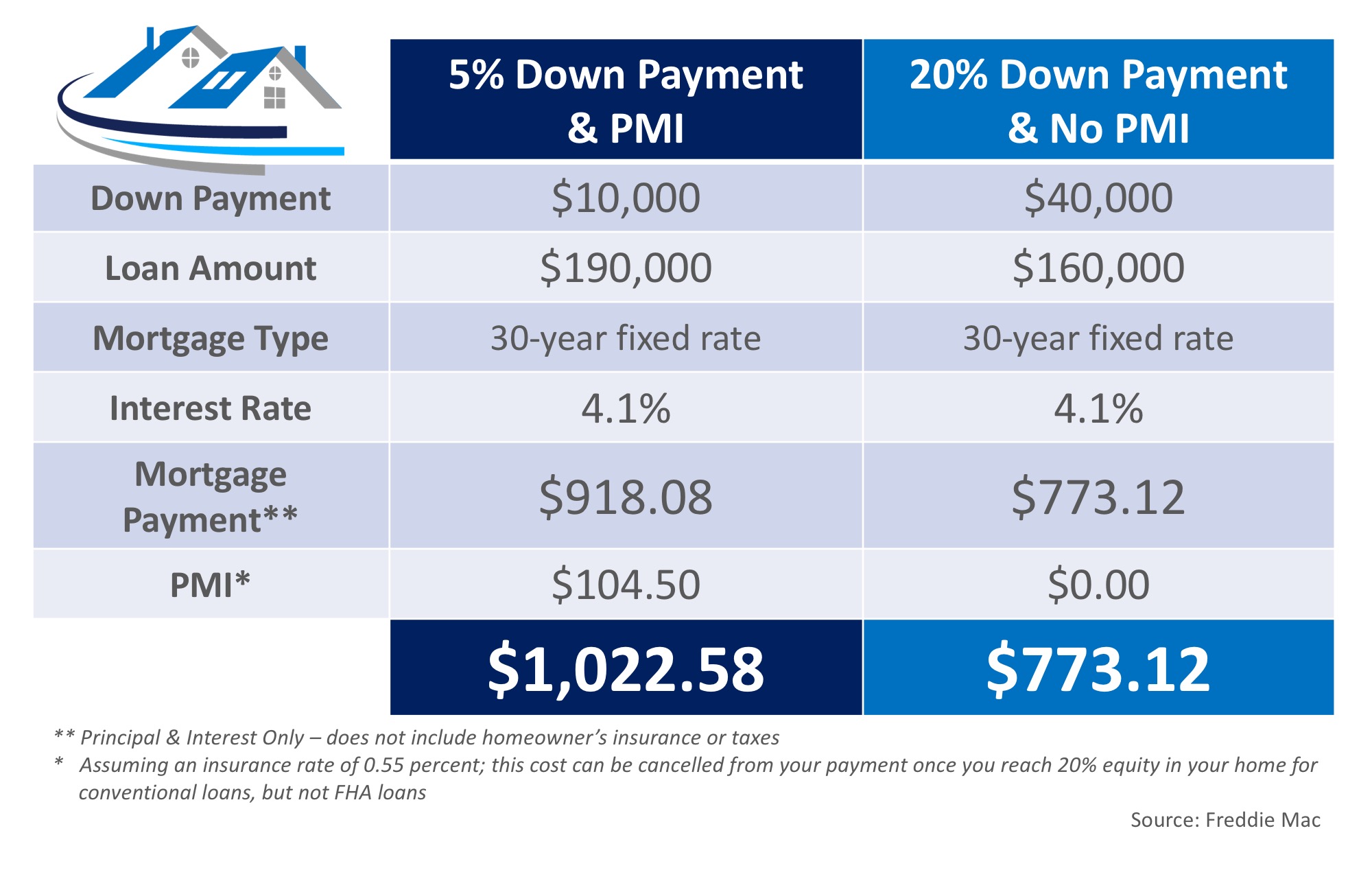

Make a large down payment. The best way to avoid pmi is to put more than 20% down on your home. For conventional loans, making a 20 percent downpayment will remove the necessity for pmi.

Get around pmi the classic way and put 20% down. Let’s take a look at the options. The most straightforward way to avoid paying pmi is by paying a down payment of at least 20 percent on your property.

Putting down 20% of a home’s purchase price eliminates pmi, which is the ideal way to go if you can afford it. How do i avoid paying a pmi? The best way to avoid paying private mortgage insurance is to save up the 20 percent needed as a down payment.

The minimum down payment you should. How to avoid paying private mortgage insurance 1. Lenders only require pmi if your down payment is less than 20% of the home’s.

In addition to saving regularly for a down payment, consider. Take out a second mortgage or piggyback loan. Whether you’re buying a home or refinancing, there are four ways to avoid paying pmi or mi.

Be sure to make all credit payments on time and clear out your credit card balances 60 to 90 days before applying for a.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-private-mortgage-insurance-pmi-and-mortgage-insurance-premium-mip-Final-fc26360e02cc4b30af01326412b49cf0.jpg)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)